The pandemic is changing everything. CPaaS providers need to change their priorities and focus as well.

It is around this time of the year that I start thinking about where the CPaaS market is headed.

Mention last year’s articles on the future of CPaaS (this one was pre-pandemic) and on how CPaaS vendors differentiate (also pre-pandemic, and so “last year”).

The pandemic is an epochal event. It caught the CPaaS industry somewhat ready, with gaps found in their video offerings. Behind the pandemic, a few other market changes are taking shape, affecting how CPaaS providers need to plan ahead.

I’d like to look at a few of these trends and outline what I see as the basis of CPaaS competition for the future.

Table of contents

- CPaaS features map

- The pandemic and CPaaS vendors

- The pandemic will pass, but digital transformation won’t

- 3 pillars of CPaaS competition and differentiation in 2021

- 1# – Machine Learning in media quality

- 2# – Video, Video, Video

- #3 – Diagnostics and analytics

- Didn’t you miss anything?

- Updating my WebRTC API report

CPaaS features map

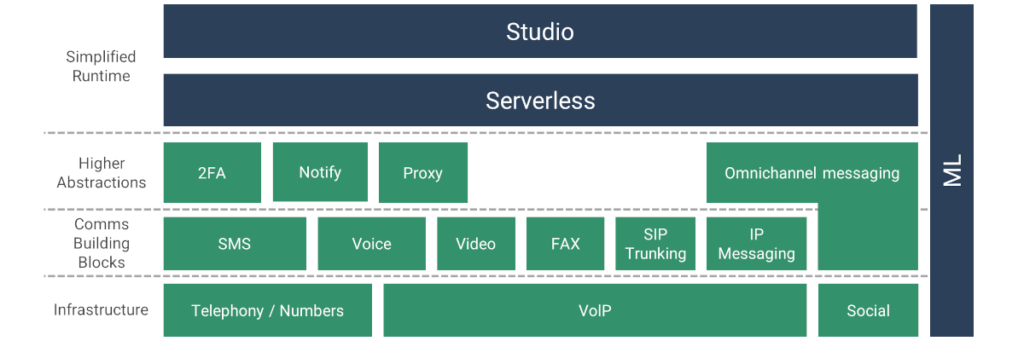

The diagram above shows the CPaaS features map. It is a kind of a marketecture diagram of the various bits and pieces that make up CPaaS.

I’ve layered it from Infrastructure, through Communications Building Blocks and Higher Abstraction to the Simplified Runtime domain. While not all CPaaS vendors will fill all building blocks in this map, they all see it in front of them one way or another.

Here are a few things to note:

- I’ve decided not to place Email or IoT in here though I could without much effort

- The importance of each block will be different for different customers and will change over time. The pandemic certainly changed priorities shifting them towards Video for example

- I am using the term Studio, though Flow is the one that is used by most of Twilio’s competitors

- ML stands for Machine Learning and it has its place throughout the CPaaS product stack. More on that later

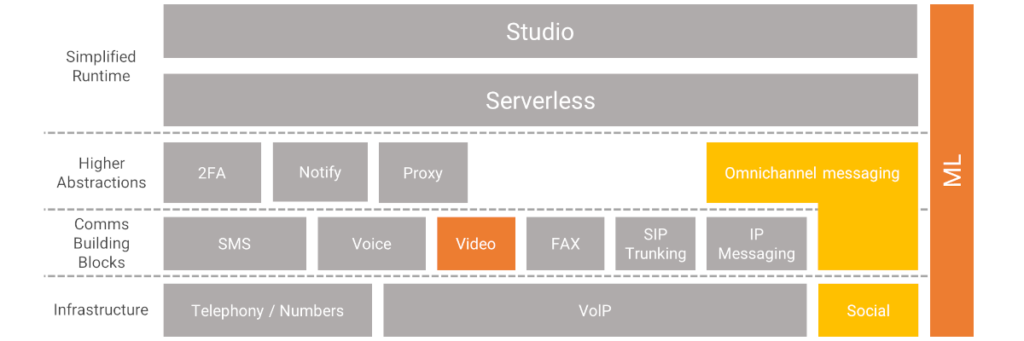

If I had to map priorities for 2021, I’d probably create this heatmap:

The pandemic and CPaaS vendors

In many ways, the pandemic is accelerating the need for CPaaS providers. The world switched en masse from one of physical interactions to a virtual one. This, in turn, exposed a few aspects in the CPaaS market.

Digital transformation fast forward

The image above circulated on Twitter some time in March-April this year. It is spot on.

Digital transformation is here and it is here to stay. It came about a few years faster than expected and to get by, companies are relying more on communications and a lot of it comes today from vendors who use CPaaS or by developing the solutions needed on top of CPaaS platforms.

The thing is, in many cases, the increase is also catching businesses off guard, with call centers and support teams being overwhelmed with incidents. And that at a point in time where everyone is forced to work from home – including the call center agents.

This in turn, increases the requirements around technologies that assist in automation of processes and communication channels. Call deflection and agent assist solutions are taking center stage. This changes a bit how CPaaS vendors need to treat communication APIs, and especially what these APIs need to enable.

Are we looking now for more or less Uber-like solutions of matching a customer to a service provider? Or are we more about getting hold of the interaction’s content in real time and injecting insights into it, with or without a human agent?

I don’t have the answers, but I have a feeling that they are different than they were 9 months ago.

CPaaS vendors totally missed video

Yap. We had CPaaS vendors doing video. A few of them. And they’re just fine. Up until the point that video becomes important for everyone and that totally new use cases pop up in our market on almost a daily basis.

Zoom doesn’t mean a magnifying glass anymore. Nor is it talking about getting a closer look.

During the pandemic?

- Daily officially launched. And raised money

- Dolby.io launched

- Agora raised some $350M in their IPO

All of the above? Focus on video communications. None of them have any telephony roots or strong telephony capabilities. No phone numbers or SMS capabilities to speak of.

AWS decided it would be nice to join the fray, so they launched their own Chime SDK. With price points that challenge the existing players.

Twilio decided this month to lower their video price points. Cutting them down by some 60%.

8×8’s Jitsi is coming up with its own managed video API service, pricing it around MAU as opposed to the more common per minute pricing.

There’s a minor price war coming up around video APIs. It will be interesting to see how this plays out.

Lack of WFH tooling in CPaaS

WFH = Work From Home

Welp… we’ve built all these nice communication services, but we’ve designed them mostly to work for the office.

On premise call centers moved to the cloud by adopting CPaaS, which is great, but the workforce itself still came to the office. All calls and communications took place from a controlled and managed environment.

The pandemic has forced call centers of tens of thousands of agents to stop coming to the office while continuing to work. From home. How do call center managers know anything about the environment of the home employee? How can he make sense of the quality of experience his agents and his customers are getting?

From the interest we see at testRTC in our qualityRTC service, there’s a real gap there.

Call this self promotion, but it is one of many areas where CPaaS vendors need to improve in order to offer a suitable WFH solution. Giving APIs is nice. Giving backend network insights and quality related dashboards is nice. Giving pre-call tests capabilities is nice. But I am not sure it is enough anymore.

Other aspects of WFH that aren’t catered for by CPaaS vendors? The need for noise suppression and background blurring/removal – to fit into the current work environments of call center agents and other workers.

The pandemic will pass, but digital transformation won’t

It was supposed to be a quick 2 months thing. Maybe 6. A year tops.

Then came Google and Facebook (not governments, because they can’t seem to be so realistic and pessimistic with their citizens), and simply let anyone work from home at least until July 2021. At least.

Fujitsu? Decided to cut office space by 50% in 3 years as the new normal.

LivePerson, an Israeli company with 1,300 employees decided to give up on its offices altogether and go 100% WFH. This saves money and apparently most employees prefer it while management doesn’t see enough of a degradation in production output.

This obviously isn’t the case everywhere. In a recent interview with the The Wall Street Journal, Reed Hastings, CEO of Netflix had this to say about remote work:

“I don’t see any positives. Not being able to get together in person, particularly internationally, is a pure negative. I’ve been super impressed at people’s sacrifices.”

To some degree, he is correct. It greatly depends on the type of industry and company.

Dean Bubley says it best about business events:

In-person business events will rise again, although I’m less certain about office work.

[…]

The #NewNormal will not be 100% remote. Once a vaccine is available, I hope that it isn’t even 50% #WFH.

My wife is a Pilates and Salsa dance teacher. She needs to work remotely now from time to time, with Zoom and recorded lessons. Her students? They’re fine with it, but whenever they can come over or do a face-to-face-in-the-flesh lesson – they’d take the opportunity.

This means that whatever it is CPaaS vendors are seeing as requirements may well stay and stick with them for the long run. What we have now isn’t a new normal, but there’s no going back to the old normal either.

3 pillars of CPaaS competition and differentiation in 2021

When I had to decide what are the main areas of investment for CPaaS when it comes to differentiation and competition towards 2021, I came to these 3 domains: machine learning, video and diagnostics.

There are two reasons why I chose these domains:

- Renewed focus on IP based communications. WebRTC and VoIP are becoming paramount to the growth and future of CPaaS. SMS and phone numbers are great money makers, but they’re not the future. The pandemic threw us a few years into the future, accelerating this trend

- Competing with in-house development. Phone numbers are complicated. Not because they are technically complex, but because they require haggling and contracting with multiple carriers around the globe, which gives an immediate advantage to CPaaS providers. With WebRTC that doesn’t exist anymore, and in-house becomes a bigger competitor to CPaaS providers. The domains below will increase the gap between build and buy for potential clients and also increase the perceived value of a solution

1# – Machine Learning in media quality

Noise suppression. Background replacement. Super resolution. Bandwidth estimation. Packet loss concealment. …

All these are algorithms in the media processing domain affecting the user experience in communications. Like everything else they are now shifting towards using a lot more machine learning than in the past.

The current forerunner in importance and mindshare is noise suppression, with a lot of partnerships and M&A activities around it.

When it comes to machine learning in media quality, what are CPaaS vendors doing today?

Almost nothing at all.

- Dolby.io have noise suppression and other audio enhancements

- Agora actively invests in machine learning. They’ve spoken about it at Kranky Geek multiple times, around super resolution and video encoding

- AWS added noise suppression to Chime, which is most likely part of the new Chime SDK. They even won an award for their noise suppression capabilities

The rest? Not doing much about machine learning, researching or doing bots.

This cannot last.

We’ve already seen how WebRTC is being unbundled for the purpose of differentiation. That differentiation will come in the form of optimizations, mostly done by use of machine learning.

What will vendors do? Especially when we see the leading UCaaS vendors actively investing in machine learning media processing capabilities? This sets the bar to what a communication service needs to look like, and without such capabilities, why should I as a developer use that CPaaS vendor?

2# – Video, Video, Video

Did I already say we’re in the year of the video?

It is.

A billion have been indoctrinated over a period of 1 month this year on how to use Zoom. don’t nitpick me on the exact number please. My mother now users Zoom in her daily life of a variety of activities, including a book reading club she joined 😲

Many CPaaS vendors had video capabilities but they usually amounted to 1:1 interactions or small group sizes. There isn’t a day going by where I don’t get a new requirement from someone that CPaaS providers can’t cater for today. Many of these are in the domain of broadcasts and large groups (100 or more participants). Using CPaaS for them today feels like hacking at best. Impossibly challenging at most.

There are many areas where CPaaS providers are lacking when it comes to video. Here are the few that immediately come to mind:

- What we are seeing is a rapid growth in the feature set and requirements of video centric use cases. These needs to be addressed. As a simple example, how do you do a live session with one presenter streaming to a large audience and the audience in turn sending their own video to the presenter, so that the presenter sees them all at the same time (or can alternate between them)?

- There’s a blurring of the lines between voice, video, broadcast and streaming. There’s a need to seamlessly switch from one to the other. Broadcast and streaming comes today predominantly from non-CPaaS vendors. There’s a growing pressure for these to be wrapped into CPaaS for interactive use cases

- Price points of video services need to be adjusted. With the change brought by AWS Chime SDK, and the pricing model of 8×8 JaaS, there are bound to be changes for other CPaaS vendors. This is imperative, especially when build vs buy decisions rely so heavily on back of the napkin calculations of minutes use multiplied by a static number

- Location of data centers and the latency brought about due to it. Most CPaaS vendors have 10 or less data centers they operate from. Now that everyone is using video, this just isn’t enough. It might be nice for voice calls in call centers, but video calls the world over are different – and they take place a lot more locally within regions and countries now, so having data centers closer to users is becoming more important than ever

The investment in video communications in all its facets will be important to stay competitive in this space.

#3 – Diagnostics and analytics

It is great that you can communicate, but what happens when things go haywire?

In my recent round of updates I am doing for my Choosing a WebRTC API Platform report, many of the vendors made sure I know they have a dashboard for quality and network monitoring. Different vendors give it different names, but they all understood that unlike telephony, there’s a need for insights here, especially since networks are unmanaged.

It isn’t about me as a client understanding if the CPaaS vendor is doing a good job, but rather about me understanding my users’ networks and experience. Current dashboard solutions will need to evolve further to give the insights their customers are looking for.

Didn’t you miss anything?

In my future of CPaaS article from last year I mentioned a few additional trends. Some of them have been reiterated here, though from a different angle and with a different narrative that fits better with the changing times.

There were three topics that weren’t mentioned here yet, and I want to give them a bit of room and explain where I see them in 2021 with CPaaS.

It would also be prudent to note how the entrance of AWS and Azure to CPaaS is going to rattle things around.

nocode / low code

Still a thing. Serverless, Flow, Zapier integration, drag and drop tools. All there. All needed.

For the most part, CPaaS vendors seem to be content with the current state of affairs and the current tools they have. Investment in this domain in 2020 didn’t yield anything vastly different, new or interesting.

The domain of nocode is still relevant and interesting. For now, it seems to be mostly limited to the telephony (and voice) aspects of CPaaS.

CCaaS and UCaaS

The lines are blurring elsewhere as well. Areas of IoT (below), messaging and notifications, live streaming – are all suitable adjacencies for expansion of CPaaS vendors.

The largest areas though are CCaaS and UCaaS: contact centers and unified communications

Acronyms will be tricky here. So bear with me.

- CCaaS and UCaaS are investing heavily in ML. A lot of it now is around #WFH

- CPaaS is going up the foodchain, mainly after CCaaS. Some do it directly (Twilio Flex), others pivoting sideways to conversations (MessageBird Omnichannel Chat Widget)

- UCaaS is vying towards CPaaS, introducing their own APIs and even CPaaS offerings

In another world, just next by, other SaaS solutions are blurring their lines. Gist (the chat widget I am using on my WebRTC course site) announced to its customers that it is releasing a full fledged CRM. From conversations to CRM.

CRMs in turn, can use CPaaS vendors directly to build up their own CCaaS offering. With the higher level abstractions geared towards customer engagement, CPaaS vendors now offer a simple route for CRMs in this direction.

This will continue, though I don’t see it as direct competition or real differentiation within the CPaaS domain itself.

IoT

Twilio seems to be the only CPaaS vendor investing in the Internet of Things. It acquired Electric Imp earlier this year. The acquisition wasn’t made with much fanfare, as this isn’t the main focus of Twilio and the current market is interested less in IoT than it is in video calls.

Is IoT part of CPaaS? Time will tell.

I believe that it is, but for now, only Twilio seems to be investing in that domain where none of its other immediate CPaaS competitors have the appetite for it. This will not change in the next couple of years as focus for CPaaS is elsewhere at the moment.

You can check out my coverage of Twilio Signal 2020 virtual event.

Updating my WebRTC API report

There’s a lot of change in the CPaaS domain. I mostly look at these vendors from a WebRTC prism, but not only.

This past month I’ve been working on updating my Choosing a WebRTC API platform report. I had a lot of briefings with the various vendors, researched their websites, added vendors, removed vendors. Grueling work.

The updated report will be published during October. It will include ~25 vendors, and touch everything from build vs buy, selection KPIs, vendor listing and pricing.

If you are looking to understand this domain better or need to select one vendor over another for an important project, then this report is for you. From today and until the report gets published, there’s a wee bit over 25% discount using coupon code API2020LAUNCH. Purchasing the report now will give you access to the current report as well as the fresh update once it is available.