CPaaS differentiation seems to be revolving around tackling niches.

UPDATE: 2020 has been a weird year. It changed everything. With it, the role of CPaaS. After you read this article, make sure to look at how the pandemic is shaping CPaaS for 2020-2021.

Time for another look at the world of CPaaS – Communication Platform as a Service. In January 2018, a bit over a year ago, I’ve looked at CPaaS trends for 2018. The ones there were:

- Serverless – which didn’t really happen, at least not as a direct CPaaS offering, other than what Twilio has to offer and what Voximplant had as well

- Omnichannel – where we see most vendors collecting channels to support, with Whatsapp being the lead noise-maker

- Visual/IDE – ended up being a winner in 2018, with Plivo, MessageBird, Voximplant and Infobip joining Twilio. It is also now usually called “Flow”

- Machine learning and AI – still more talk than action, but we’re moving in this direction. The whole industry is

- AR/VR – happening, though less with the CPaaS vendors directly

- Bots – that’s part of the omnichannel + ML/AI story. And we see instances of it done with CPaaS

- GDPR – something that was done and somehow mostly forgotten

I’d like to look at what’s happening in CPaaS this time from a slightly different angle, which alludes itself to trends as well, but in a more nuanced way. From briefings I’ve been given this past few weeks and the announcements and stories coming out of Enterprise Connect 2019, it looks like different CPaaS vendors are settling on different target audiences and catering to different use cases and market niches.

Today CPaaS is almost synonymous to Twilio. Every player looks at what Twilio does in order to plot its own route in the market, at times, with the intended aim of disrupting Twilio and then mostly with lower price points. In other times, with trying to offer something more/better.

Then there are external players who add APIs to their platform. Usually UCaaS (Unified Communications as a Service) platform. They don’t directly compete with CPaaS, but if you are purchasing a “phone system” for your enterprise from a UCaaS player, then why not use its APIs and services instead of opting for another vendor (a CPaaS vendor in this case)?

Planning on selecting a CPaaS vendor? Check out this shortlist of CPaaS vendor selection metrics:

Here are how some of the vendors in this space are trying to differentiate, pivot and/or find their niche within the CPaaS market.

Agora.io – Gaming

If you look at Agora’s blog, what you’ll find out there is a slew of posts around gaming and gaming related frameworks (Unity to be exact):

- It’s How You Play the Game: Trends at Game Developers Conference – Day 1 Recap

- Adding Voice Chat to a Multiplayer Cross-Platform Unity game

- How To: Create a Video Chat App in Unity

- Add Voice Chat to your Unity game

- (iOS) Run Video Chat within your Unity application

- (Android) Run Video Chat within your Unity application

- …

Gaming is an untapped market for CPaaS.

There’s communications there of all kinds – collaboration or communications across gamers inside a game, talking before the game, streaming the game to viewers, etc.

All this communications is either developed by the gaming companies (not a lot), being catered for by specialized VoIP gaming vendors, done out of scope (using Discord, Skype, …). Rarely is it covered by a CPaaS vendor.

Somehow, for CPaaS cracking this market is really tough. Agora.io is trying to do just that, along with its other focus areas – live broadcast and social (two other tough nuts).

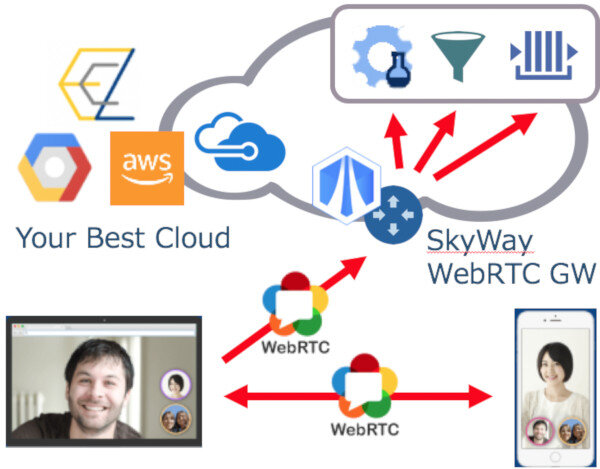

ECLWebRTC – Media Pipeline

The Japanese platform from NTT Communications – ECLWebRTC.

Like many of the WebRTC-first/only platforms out there, ECLWebRTC had an SFU implementation and support for various devices and browsers.

When you get to that point, one approach is to go after voice and PSTN. Another one is to add more features and increase the sizes of meetings and live broadcasts that can be supported.

ECLWebRTC decided to go after machine learning here, with the intent of letting its customers integrate and connect its media paths directly to cloud APIs. This is done using what they call Media Pipeline Factory, which feels from the looks of it like a general purpose media server.

ECLWebRTC is less known in Europe and the US, and probably not much outside of Japan either. With the Japanese market focus on automation, it makes sense that media pipeline would be a focus area for ECLWebRTC. This type of a capability is relevant elsewhere as well, but it doesn’t seem to be a priority for others yet.

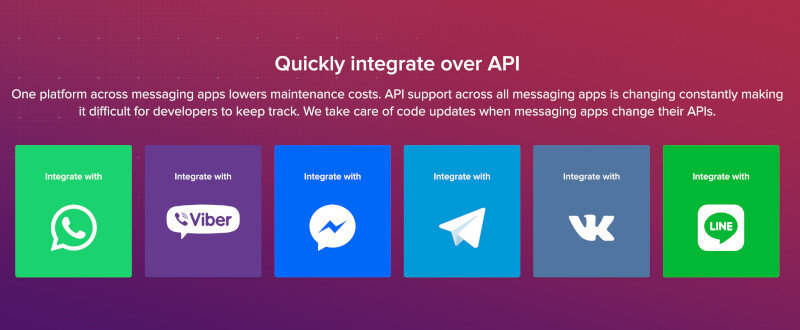

Infobip – Omnichannel

I’ve had the opportunity to fiddle around with Infobip Flow recently, something that turned out to be a very pleasant experience. From Flow, it became apparent that Infobip is working hard on offering its customers an omnichannel experience. Compared to other CPaaS vendors, they seem to have the most coverage of channels:

To the above, you can add SMS and RCS and email.

Infobip Flow has another nice quality – it is built for both inbound and outbound communications. Most of its competitors do inbound flows only.

In a world where competition may force price wars on CPaaS basic offerings of voice and SMS, adding support for omnichannel seems like a good way to limit attrition and churn and increase vendor lock-in.

RingCentral – Embeddables

RingCentral isn’t a CPaaS vendor. They offer a communication service for the enterprise. You got a company and need a way to communicate? There’s RingCentral.

What they’ve done in the past couple of years was add an API layer to some of their services. Things like pushing messages into Glip, handling phone calls, etc.

The idea is that if you need something done in an automated fashion in RingCentral you can use the API for it. In many simple cases, this might be used instead of adopting CPaaS APIs. in other cases, it is about using a single vendor or having specific integrations relevant to the RingCentral platform.

What RingCentral did was add what they call Embeddable:

“With RingCentral Embeddable, you can embed a full-featured softphone into your favorite web application for an integrated communications experience that drives productivity and ease of use without lengthy development time“

This concept of embedding a piece of code isn’t new – YouTube videos offer such a capability as well as a slew of other services out there. When it comes to communications, it is similar in nature to what TokBox has in the form of Video Chat Embeds but done at the level of users and their user accounts on RingCentral.

This definitely makes integrations of RingCentral with CRM tools a lot easier to get done, and makes it easier to non-developers to engage with them – similar to how Flow type offerings make it easier for non-developers to handle communication flows.

SignalWire – Price and Flexibility

SignalWire is an interesting proposition. It comes from the team that created and is maintaining FreeSWITCH, the leading open source framework used today by many communication providers, including some of the CPaaS vendors.

The FreeSWITCH team decided to build their own managed service (=CPaaS in this case), calling it SignalWire. Here’s a few examples of the punchy copy they have on their website:

- Advanced communications from the source

- We don’t price gouge you for carrier services like per-minute and per-message rates. Focus on what’s important to your business, not your phone bill

What they seem to be aiming for are two things: price and flexibility

Price

They offer close to whole-sale price points (at least based on the website – I haven’t gone to a price comparison on this one, though their sample pricing for the US does seem low).

To make things easier, they are targeting Twilio customers, doing that by offering TwiML support (similar to what Pilvo did/is doing). TwiML is a markup language for Twilio, which can be used to control what happens on connected calls. Continuing with the blunt approach, SignalWire calls this LāML – Legacy Antiquated Markup Language.

While this may fit a certain type of Twilio customers, it certainly doesn’t cover the whole gamut of Twilio services today.

Flexibility

On the flexibility front, there’s mostly marketing messages today and not any real announced products on the SignalWire website.

Besides LāML there’s a WebSocket based client API/SDK, not so different than what you’ll find elsewhere.

They can probably get away with it in the sales process by saying “we give you FreeSWITCH from the source”, but I am not sure what happens when developers want to configure that elastic cloud service the way they are used to be doing with their own FreeSWITCH installation.

All in all, this is an interesting offering and an interesting approach and go to market.

TeleSign – Security and Data Analytics

TeleSign is focused on SMS. And a bit of voice. As their website states: “APIs Delivering User Verification, Data Insights & Communications”

Since security, verification and fraud prevention these days rely heavily on analytics, TeleSign are “horeding” data about phone numbers, using it for these use cases. It isn’t that others don’t do it (there’s Twilio Authy, nexmo Number Insight and others), but this is what they are putting front and center.

Since their acquisition by BICS, a wholesale operator for wireline and wireless carries, that has grown even further, as they gain access to more and more data.

It will be interesting to see how TeleSign grows their business from security to additional communication domains, or will they try to focus on security and expand from the telecom space to adjacent areas.

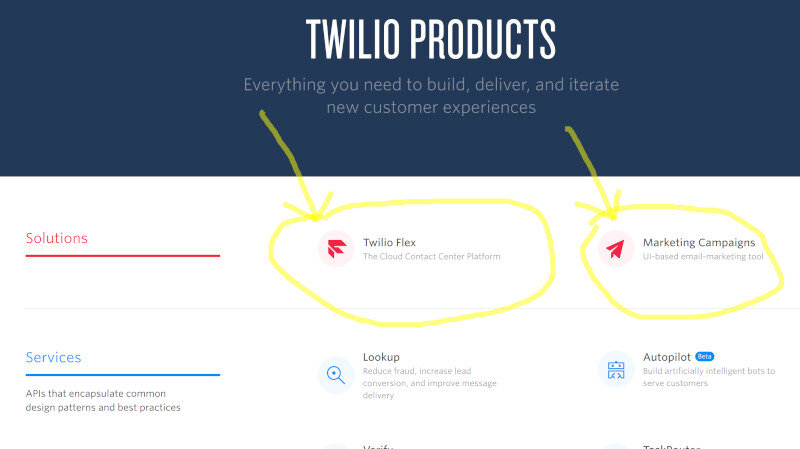

Twilio – Adjacencies

Talking about adjacencies, that’s what Twilio is doing. Now that they are a public company, there is even more insatiability for growth within Twilio, in an effort to find more revenue streams. So far, this has worked great for Twilio.

Here are two areas we’ve seen Twilio going into:

- Contact centers, shifting away from developers per se with their CPaaS platform towards a cloud based contact center offering, competing head to head with some of their own customers (that would be Twilio Flex)

- Email, through the acquisition of SendGrid

How email fits into the Twilio communication APIs is still an open question, though I can see a few interesting initiatives there.

And then there’s the wireless offering of Twilio, which resembles a more flexible M2M play.

But where would Twilio go next?

UCaaS, going after unified communications vendors and competing with them head to head?

Maybe try to jump towards an Intercom like service of its own? Or purchase Intercom?

Or find another market of developers that is growing nicely – similar maybe to its recent Stripe integration of Twilio Pay.

Twilio in a way has been defining and redefining what CPaaS is for the past several years. They need to continue doing that to stay in the lead and well ahead of their competition.

VoIP Innovations – Marketplace

VoIP Innovations came out with what they call Showroom.

Here’s a short video of the explanation of what that is exactly:

Many of the CPaaS vendors offer a partner program of sorts. This is where vendors who develop stuff for others or build tooling and apps on top of the CPaaS vendor’s APIs can go and showcase their work. The programs vary from CPaaS company to another.

Twilio has Showcase as well as an add-on marketplace of sorts. Nexmo has a partners directory. VoIP Innovations are banking on their showroom.

What makes it different a bit is the target audience associated with it:

- Developers – obvious, as CPaaS caters first and foremost for developers

- Resellers – who can pick off marketplace apps, whitelabel and resell them

- Subscribers – who pay for that privilege

While there isn’t much documentation to go about, I am assuming that the whole intent behind the marketplace is to offer direct monetization opportunities for developers and resellers by taking care of customer acquisition as well as payment on behalf of the developer and reseller.

A concept taken from other marketplaces (think mobile app stores). It will be intersting to see how successful this will be.

Vonage – UCaaS+CPaaS

Vonage is interesting. Started as consumer VoIP, turned cloud UC vendor (=enterprise communications) through acquisitions, turned to acquire Nexmo and then TokBox to add CPaaS, continued with NewVoiceMedia acquisition to cover contact center space.

How does one differentiate in such a way? Probably by leveraging synergies across its product offerings and markets.

What Vonage recently did was bring number programmability from its Nexmo/CPaaS offering to its VBC/UCaaS platform.

What do they gain?

- Single API across product lines, making it easier to learn and use the same APIs

- Large ecosystem of developers using Nexmo able to build on VBC – it is… the same API

- The level of flexibility that a CPaaS platform has right on top of a UCaaS offering. In this case, scripting using Nexmo NCCO

Is this good for Nexmo customers and partners? Yap. They can now reach out to the Vonage business customers as an additional target market.

Is this good for Vonage customers and partners? Yap. They can now do more, and more customized communications solutions with this added flexibility.

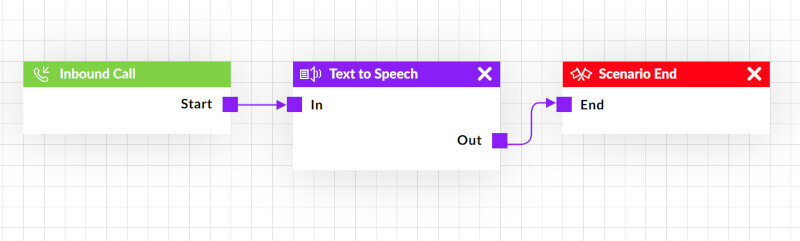

Voximplant – Flow

Voximplant is one of the lesser known CPaaS vendors. Its whole platform is built on the concept of an App Engine, where you write the communications logic right onto their platform using Java Script. It is serverless from the ground up. A year or two ago, Voximplant added Smartcalls. A product that enables you to sketch out call flows for outbound interactions – marketing, sales, etc. These interactions would be played out across a large number of phone numbers and get automated, making it really easy and flexible to drive phone based campaigns.

Now? Voximplant took the next step of adding inbound interactions, covering the IVR and contact center types of scenarios.

Twilio, MessageBird and Plivo offer inbound visual flow products. These allow developers to drag and drop communication widgets to build a flow – a customer interaction through the system.

Voximplant and Infobip offer inbound and outbound flows, where you can also plot company/agent based initiatives with greater ease as well as the customer initiated interactions.

Why aren’t you listed here?

The CPaaS market is large and varied. It is hard to see everyone all the time. It is also hard to innovate and differentiate every year. The vendors here are the ones I had briefings with or ones who promoted their products in ways that were visible to me. But more than anything, these are the ones that I felt have changed their offerings in the past year in a differentiating manner.

BTW – if you think that differentiation here means that it is a functionality that other vendors don’t have then you are wrong. Doing that is close to impossible today. Differentiation is simply where each vendor is putting his focus and trying to attract customers and carve his niche within the broader market. It is the stories each vendor tells about his product.

If you feel like a vendor needs to be here, or did something meaningful and interesting, just contact me. I am always happy to learn more about what is happening in the market.

Who is missing in my WebRTC PaaS report?

Later this month, I will be releasing my latest update of the WebRTC PaaS report.

There are changes taking place in the market, and what vendors are offering in the WebRTC space as a managed API service is also changing. This report is there to guide buyers and sellers in the market on what to do.

For buyers, it is about which platform to pick for their project – or in some cases, in which of the platform vendors to invest.

For sellers, it is about what to add to their roadmap. To understand how they are viewed from the outside and how do they compare to their peers.

Here’s who’s been in the last update of the report:

Think you should be there? Contact me.

Want to purchase the report? There’s a 30% discount on it from today and until the update gets published (and yes – you will be receiving the update once it gets published for no additional fee).

There will be a new appendix in the report, covering the topic of Flow and Embeddable trends in the market. Something that will become more important as we move forward.

Thanks for the article! We also explored the CPaaS market and compared all the major players: https://madappgang.com/blog/twilio-alternatives-how-to-integrate-messages-and-calls-into-your-app/

Great summary, thanks!