Twilio Programmable Video is no more. What should WebRTC Video API vendors and their customers do from here on?

This week, Twilio dropped a bombshell 🤯

It decided to shut down its Programmable Video service and do a bit of downsizing and trimming around Segment and Flex.

I didn’t intend to write anything more until 2024, but this necessitated changing my plans.

💡 The image above is an adaptation from a blog post on Twilio’s website from 2021…

Table of contents

- Twilio Signal, and why I stopped covering it

- CPaaS vendors: Best of breed vs best of suite

- The cases of Twilio IOT and Twilio Live

- The demise of Twilio Programmable Video

- Innovations in Video APIs and WebRTC managed services

- The rise of the Zoom Video SDK

- The future of managed Video APIs (without Twilio)

- Where should Twilio Video customers go from here?

Twilio Signal, and why I stopped covering it

Each year, Twilio hosts its Twilio Signal event. I’ve attended a couple of them in person and used to cover them here on a yearly basis.

That stopped with Twilio Signal 2021, which was the last time I covered that event here. The reason for that was the pivot Twilio made from CPaaS to CEP (Customer Engagement Platform).

Ever since, I’ve searched for things to talk about and share about Twilio Signal, but found nothing of real value or interest to my readers.

Remember – I cover WebRTC and CPaaS. CPaaS mainly from the point of view of WebRTC and modern communications and less from the SMS and legacy telephony sides of it.

The shift towards CEP meant a lot less investment and focus by Twilio on exactly these areas – WebRTC and CPaaS that are non-SMS/legacy telephony related.

What did Twilio have to show for its investment in video and WebRTC in 2022 and 2023? Nothing. Crickets. Oh… yes… they did integrate with Krisp for noise cancellation. Presumably only in their Video SDK and not the Voice SDK. So that’s down the drain as well.

The decision might be the right one for Twilio, if you look at where their investments and attention are going:

- Twilio Flex, for a programmable contact center

- Segment, as a leading CDP vendor

- Fuzing Segment with programmable communications

Video is likely 1% or less of their revenue. So why bother? Especially when it requires management attention to get it anywhere meaningful with so much else that is bigger and more important to deal with.

CPaaS vendors: Best of breed vs best of suite

I learned about the concepts of best of breed and best of suite when working at Amdocs.

- A best of breed vendor would specialize vertically, offering its customers a solution that is great in a narrow domain. Think of it as “the leading SMS vendor”. You do SMS and only SMS and you do it really well

- Best of suite is all about the breadth of your offering. You provide a solution that has a mixture of multiple services and features your customers will need. You might not be doing any of them the best in the market, but if someone needs multiple services and wants a single vendor to work with – you’re the best for them. Think of it as offering SMS, voice, email, video, … – Twilio

Twilio started with SMS and voice. It later decided to expand and become “best of suite” by attaching to it email, video, IOT, social messaging, chat , …

What happened though is that in parallel, it worked hard on being best of breed in voice and SMS. Doing that by going upstream and introducing Flex. Flex reduced the effort of contact centers built on top of Twilio.

And then they pivoted. With the acquisition of Segment and the need to tightly integrate it with their CPaaS and Flex offering. Transitioning from taking care of communications to taking care of understanding the customer.

Today?

There are two types of CPaaS vendors:

- The best of suite ones, who offer the breadth of communication services

- Or the best of breed ones, who focus on a specific domain. And the domain I care about is WebRTC and video. These usually won’t have legacy telephony. At most, they will enable connecting to legacy telephony of third parties

Interestingly, both are circling like vultures around Twilio to see which customers are going to come out of there looking for alternatives. Some of these CPaaS vultures offer pure WebRTC video solutions. Others offer the whole suite. And there are those who don’t even offer video – but see this as an opportunity to poach customers from Twilio.

The cases of Twilio IOT and Twilio Live

I remember that in one of the first Twilio Signal events, Jeff Lawson stood on stage and proudly announced that they never deprecated an official API. The way this was later handled is by having beta and GA phases for products.

This cannot be said anymore… by the end of 2022, Twilio started sunsetting and shutting down services.

It started with a round of layoffs at Twilio. Jeff Lawson, Twilio’s CEO, wrote a message that got to the Twilio blog as well. Here’s what we shared about it at the time with our WebRTC Insights clients:

- Twilio laid off 11% of their workforce

- The decision was to take the internal email and publicly put that on their blog, instead of getting it indirectly on TechCrunch

- A few interesting to note in this email:

- Twilio has 4 focus areas: reliability+trust, profitability of messaging, Segment adoption, Flex customer base

- 3 main products in focus: messaging, Segment (Customer Data Platform), Flex (Programmable Contact Center)

- Programmable Video isn’t prioritized at all. Programmable Voice might be said to be buried somewhere in there under Flex

- Twilio’s future success and growth lies Segment and Flex – not in Communication APIs

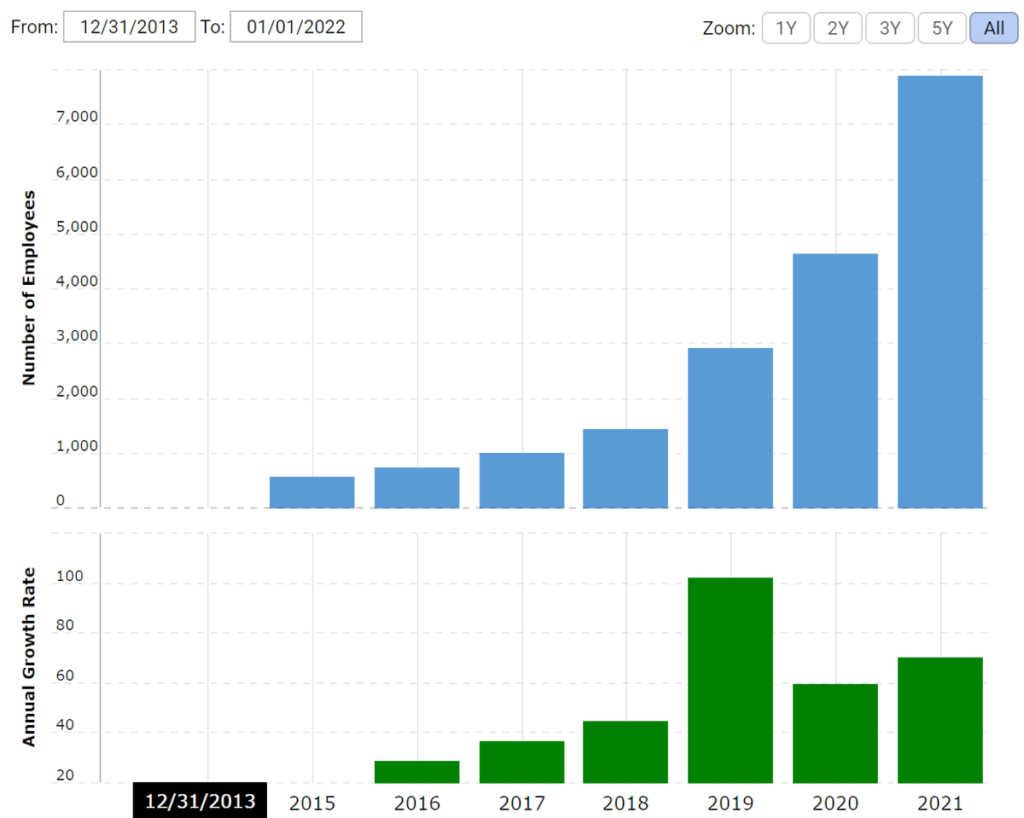

- The charts below show the number of employees and growth rate of Twilio in recent years

- Why is Twilio doing this? A few options here

- Growth is slowing, and all the hiring they did is just too much to maintain

- Management has too many directions it is now looking at, so it was time to shoot down all the smaller initiatives and products since they won’t bring the necessary growth at Twilio’s size

- Twilio might have used the current market state to clean the stables and remove all the useless fat from the company

- All of the above, to some extent

- How will this affect other CPaaS vendors? This is hard to say. Here are a few thoughts

- If Twilio is in poor shape, then the rest are in worst one

- With Twilio management shifting focus elsewhere, the API space, and especially in voice and video, it is down on these areas to build some differentiation

- Time to use FUD in the market against using Twilio for video APIs – Jeff just said it isn’t a focus area. Just make sure it doesn’t backfire…

- Maybe CPaaS isn’t as great as it was believed to be as a business…

- From my past life I know that selling to developers is super hard

- And the target market for it is rather limited

- There are better opportunities out there, which is why many CPaaS vendors are following in Twilio’s steps when it comes to Flex

- Also, if you are looking for developers, it might be worthwhile to try and poach a few of those who still work at Twilio, or more easily those who are looking for a new job

After the reduction in workforce, came the reduction in product offerings. The first two to go through the chopping block were Twilio IOT and Twilio Live.

Twilio Live was announced dead in November 2022. Low traction of the service and little fit the the direction of Twilio meant this had to die. The way this was done? Let customers know. Officially suggest they go use Mux instead. Somehow, the fact that Mux at the time had a service competing directly with Twilio Programmable Video wasn’t something that worried Twilio.

Twilio IOT was simply sold off to KORE Wireless in March 2023.

Remember that suggestion we gave about FUD in the market against using Twilio for video APIs? (I marked it in yellow above so you won’t miss it)

The demise of Twilio Programmable Video

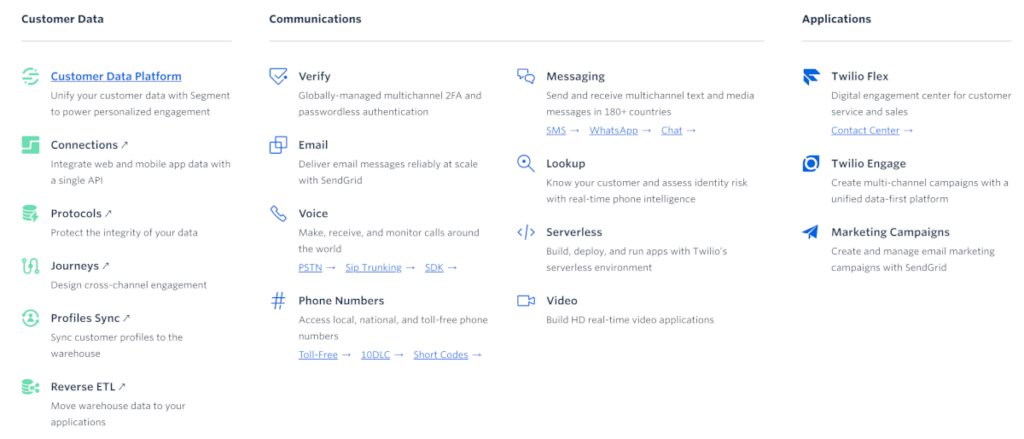

Here’s what the Twilio product menu looks like on their homepage:

This is likely going to change soon or by the time this gets published.

- Customer Data = Segment offering

- Communications = CPaaS

- Applications = Enterprise stuff

Each and every piece in the Communications part can be snuggly fit into the products on the left and on the right (Customer Data and Applications).

Video is a bit of a stretch. At least if you look closely at traffic sizes and revenue numbers.

The two other oddballs – IOT and video streaming – were thrown out without too many objections and without hurting Twilio’ bottom line.

What was left was to get rid of the video piece. It likely took too many resources but made no real dent in Twilio’s numbers.

To be frank – the problems likely started with the acquisition of Kurento. Kurento wasn’t fit for what they had in mind for it, and it was riddled with architectural and technical issues. This wasn’t a good starting point for multiparty calling in Twilio Programmable Video.

If I had to guess, a lot of technical debt went into the product to improve and repurpose the media server pieces of Kurento.

Twilio was slow to innovate on video, leaving the room for other vendors – big and small. It missed the lowcode and embeddable experiences that are now common in video APIs. They didn’t invest in AI integrations too much. It didn’t optimize media quality enough to work well for its customers.

And then it left the door open for Amazon with their Chime SDK to threaten them in this domain.

I am guessing growth and revenue from Twilio Programmable Video wasn’t in line of expectations (unsurprisingly). The current market climate, the end of the pandemic, the headaches in Segment and Flex. All of it got them to the conclusion that it would be simpler to just sunset Twilio Programmable Video and move on.

A brave decision. Twilio Programmable Video couldn’t have been sunset in the worst time (unless you consider a few months prior to the pandemic and the quarantines).

A week before this announcement from Twilio, Amazon announced support for video calling in Amazon Connect.

Amazon is investing in adding video to its contact center solution, and Twilio, who has Twilio Flex competing against Amazon Connect, is sunsetting video support for its video API.

- What does it mean for video calling support in Twilio Flex?

- Would Twilio still support or add video calling to Twilio Flex without offering Programmable Video APIs?

- How should contact center customers view this? If they have video requirements in their roadmap, would they use Amazon Connect or Twilio Flex?

Innovations in Video APIs and WebRTC managed services

Why was Twilio Programmable Video appealing to potential customers? I can think of two main reasons:

- Single throat to choke. Sourcing your voice, SMS and video from the same vendor, on a single bill is an advantage

- A reputable vendor. It is Twilio. They are big. What can ever go wrong? …

The reasons why not to? Quite a few:

- Quality wasn’t on par with what can be achieved elsewhere with CPaaS vendors

- No lowcode/embeddable offering for its video API

- Support… could be better

- No innovation

All that Twilio had for itself is its brand name. And that in a market that was moving on.

Things other vendors have been doing in that period of time?

- Doubling down on large scale sessions, with 10,000 or more users

- Live streaming solutions (the one Twilio sunset in 2022 – Twilio Live)

- Investing in AI integrations and pipelines, both on client side and on server side

- 3D audio, VP9 video codec support

- Nocode/lowcode solutions

Twilio wasn’t able to keep up. Or even pick a direction it wanted to invest in.

The rise of the Zoom Video SDK

Twilio issued an email to its customers on December 5, stating the sunset will take a full year. From this email:

[…] we have decided to End of Life (EOL) our Programmable Video product on December 5, 2024, and we are recommending our customers migrate to the Zoom Video SDK for your video needs.

The official recommendation from Twilio is for their customers to migrate to the Zoom Video SDK.

The announcement can’t be found (yet) on any marketing material from Twilio. It can be found on social media accounts from Zoom.

Why Zoom?

- Zoom isn’t a competitor of Twilio in anything, and are unlikely to be any time soon

- It is a large and respectable vendor with a brand name

They couldn’t suggest vendors that have SMS or voice services.

The rest are mostly smaller vendors – not something Twilio wanted to be identified with is my guess.

There’s only one problem with picking Zoom Video SDK here. Their web experience isn’t on par with the rest of the pack. They rely on WebTransport+WebCodecs+WebAssembly, which isn’t as stable or performant as just using WebRTC. For native, their SDKs should be fine, but for web browsers, I’d be reluctant to use them yet. Add to that the fact that this is a technology shift, requiring some relearning of terms and a reliance on proprietary technology, and you get some increased risk for the vendors switching.

I wonder if Twilio and Zoom came to an agreement here (with Zoom maybe even paying for this suggestion to go out) or if Twilio simply decided to offer some kind of a recommendation and be done with it. Philipp’s bet: Eric Yuan had dinner with Jeff Lawson and paid for it.

Anyhow, customers have a full year to figure out a solution. Or less – depending on how much browsers WebRTC implementations drift away from the current implementation of Twilio. What doesn’t get maintained in WebRTC rots rather quickly.

The future of managed Video APIs (without Twilio)

I am not sure how much Twilio Programmable Video would be missed.

Developers certainly used it. Big and small. Its revenue was probably higher than some of the smaller video API vendors out there. These developers will figure out a way to migrate to other vendors to use. It won’t be the first time a CPaaS vendor has existed in the video API market (we had AddLive, vLine, ooVoo, SightCall, Respoke, Tropo, Forge, CafeX, Circuit, Bit6 all exit this market in the past).

3-4 years ago, we had 3 top dogs in this market: Vonage, Twilio, Agora

A year ago, I’d say I heard a lot more about Vonage, Amazon Chime SDK and Twilio. Less so Agora

Now, we have Vonage and Amazon Chime SDK

Who will take the 3rd spot in the 3 runners when it comes to developers’ mindshare in this industry?

We have Agora, Daily, Dolby, LiveKit and others who are all vying for that spot. Each has its own angle and differentiation.

Would Vonage keep its spot there?

Will Amazon continue investing in its Chime SDK enough?

I don’t have the answers to these questions, but I do have my own opinions.

Where should Twilio Video customers go from here?

That is the big question.

If you are using Twilio Programmable Video – who should you go to instead?

And if you are on the lookout for a CPaaS vendor now – who should you pick?

My WebRTC Developer Landscape infographic was last updated in 2022, but can still offer some guidance as to the alternatives available. Some of them I’ve listed throughout this article. Others are just as valid.

Here are a few questions you need to answer for yourself:

- What are your requirements and focus? Different CPaaS vendors offer a different type of a solution, so pick one that offers what it is you’re after

- Make sure you ask around. Check references. Talk with other developers who use that CPaaS vendor

- Try them out in a small POC before fully committing yourself

- Check their commitment and level of investment in what it is you focus on as your requirements and roadmap. Don’t only listen to what they say – also check out what features they introduced to the market in the last 12-24 months. See if they had layoffs in that same period of time as well, and make an educated guess if they will be around a year from now. Maybe wait six months until making the decision

- Don’t invest in abstraction layers to be able to replace CPaaS vendors. It sounds like a great initiative and project, so just don’t do it. Unless you want to use more than a single vendor at a time (unlikely for most of us)

- While you shouldn’t invest in an abstraction layer, you should definitely try to limit calls to the CPaaS vendor’s APIs to specific modules in your code. If you can limit it to a single source file or class – even better

Make sure also to read my CPaaS vendor lockin article before making any decision here…