Making a CPaaS platform is not easy. Making one that is differentiated? That’s even harder.

Vidyo announced their new CPaaS called vidyo.io last week. It has been around for some time now – I covered it a couple of months ago on SearchUC – Vidyo migrating from enterprise video conferencing to video APIs. Now it is officially out, and I want to take a closer look at it.

Vidyo is/was an enterprise video conferencing company. Their focus throughout the years has been around software based solutions that make use of Scalable Video Coding – SVC. Its main competitors were probably Cisco, Polycom and Avaya – all operating in the same space.

But now, things are rather different. Vidyo has decided to go after two adjacencies at the same time – UCaaS as CPaaS:

- UCaaS – VidyoCloud offering a managed video conferencing service for the enterprise. A competitor to companies such as BlueJeans and Zoom (the latter just raised $100m at $1b valuation)

- CPaaS – vidyo.io offering an API for developers that does… video conferencing that can be embedded virtually everywhere

CPaaS isn’t something new. I have been covering the WebRTC part of it for quite some time in my own WebRTC PaaS report. And there are lots and lots of companies in that space already. So why bother with yet-another-one in 2017?

That’s a question for the vendors who join the market, but I’d say this. You can be one of two types of companies:

- A direct competitor to Twilio, the jack of all trades when it comes to CPaaS. This means you’ll need to support anything and everything related to communications AND give developers a reason to use your platform instead of Twilio (good luck with that)

- Become differentiated in a way that leaves developers no choice but to come to you. How do you do that? Beats me if I know. I just write here 🙂

Vidyo took the latter approach with vidyo.io, going for differentiation.

What is it that can make vidyo.io so enticing to developers and differentiate them from the crowd? Here’s what I came up with.

#1 – Razor focus on video

Vidyo does video. Not much more. There aren’t many players in this specific category besides maybe TokBox. ooVoo might be considered as another such player, at least to some extent.

This resistence to fill in the legacy gaps of voice and SMS probably isn’t an easy one. There’s a need to maintain a lead in the technology and the capability of the IP based video communications and at the same time believe that that lead is warranted and perceived by customers as an advantage.

Would you source your video from a second vendor or just take what Twilio or any other CPaaS player you’ve picked up for your phone calling do the video part for you as well? Maybe. Maybe not. Depending how critical video is for you and what features are you looking for. For mission critical applications such as healthcare, financial services or even customer engagement, you might not want to take the risk when you don’t have to.

#2 – Enterprise Savviness

Everyone wants to go after the enterprise these days.

Developers are hard to work with when it comes to developer tools:

- They aren’t the ones controlling the budget, so hard to get them to pay

- They are usually cheap in how much they are willing to pay

- And that’s because they think they can develop what you have on their own. How hard can it be to take a FREE WebRTC thingy and turn it into a managed service?

Mitigating that gap with the longtail world of developers is hard. So once a platform goes there, it will usually try going upmarket to get enterprise customers. This is one of the reasons that Twilio launched an enterprise plan last year.

Vidyo comes from the enterprise world, boasting as its customers government agencies, financial institutes, healthcare providers and contact centers. In all cases, big names who adopted Vidyo technology in one way or the other to add video to their business needs.

#3 – SVC, in all its glory

There’s a notion that SVC is necessary for multiparty video conferences, and while the answer is that it is, SVC done right also improves video quality in mobile devices over error prone networks.

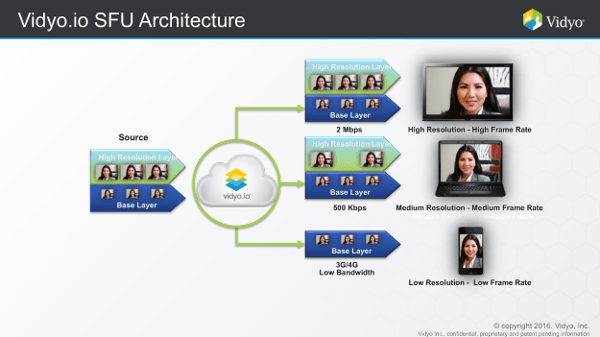

You see, SVC enables you to create different layers:

The sender sends all layers and the server then peels the layers it thinks are the best that can fit to the device they are intended for. So if we send to multiple devices – we can just fit for each device his own view at a lower cost to our server. Which is why SVC is so good for multiparty calls.

For mobile? If I can split a stream into several layers, I can decide to “protect” the lower more important layers by increasing their probability of being received. How do I do that? I add Forward Error Correction. This means you can improve video quality in really bad networks – Vidyo has that in their platform for quite some time, making it one of the few players today with WebRTC that can do that.

There’s a lot more to it than that, as Vidyo has been making use of SVC longer than anyone else out there in the industry. Vidyo is also the only CPaaS vendor in the market who offers that as far as I know. You can read more about it in their technology overview on vidyo.io.

Which brings us to the Google angle.

#4 – The Google angle

We’re now in a world of VP8 and H.264 in WebRTC. That’s the video codecs you see deployed in the market. Will this trend continue? Unlikely. Technology waits for no one. H.264 is old. Its first version was officially released in 2003. It has improved, but it is time to start the transition as an industry to a new video codec. VP8 was meant to be on par with H.264. Its successor is VP9 or H.265).

In all browser based WebRTC implementations we either already have VP9 support or will have VP9 support. And VP9 is where scalability will happen for WebRTC. A great deal of that is taking place by a cooperation between Google and Vidyo – one that I am not privy to.

The end result? Vidyo will probably have the first SVC-enabled video routing infrastructure that works with Chrome’s VP9 implementation. And this, in turn, can give Vidyo a huge headstart over other platforms.

Can Vidyo succeed with vidyo.io?

Yes. It will be a question of execution, as the path isn’t an easy one.

There are two challenges here that Vidyo is taking upon itself:

- Migrating to the cloud, with its own business model challenges

- Working with developers and selling a platform and not a product, which is a different ballgame with different rules of engagement

The first point is something that Vidyo has already committed to with VidyoCloud. It is a shift that is happening – with or without the developers angle. This means that management and shareholders are already bought into the cloud strategy and will have the patience to wait until Vidyo shifts and sees enough success in this “new” market.

The second point is where the real challenges will occur. There are different things that take place when you work with developers and on a managed service. Marketing works differently. Documentation and support are also handled differently. The sales processes are different. Vidyo will need to fill in these gaps and learn fast while maintaining its position in the enterprise. Being able to do that will mean being able to win more enterprise customers with vidyo.io

CPaaS Differentiation in 2017

As we enter 2016, differentiation in the CPaaS space will be important.

The notion of “cheaper than X” will not work. It leads to a price war where nobody wins. These managed services require scale, but the market is still new and nascent, so real scale isn’t here just yet for the most part. Reducing prices and going down to AWS levels make no sense. Especially if you consider the investment in ongoing development that is required in this market.

Vendors are finding their way in this market, each trying to differentiate and carve its own niche. Vidyo may well have found its own where their strength in multiparty quality over mobile can be a differentiator. Time will tell how successful they will be.

For developers? This is definitely a big win, as there are more alternatives on the table, with Vidyo joining in and adding their enterprise video tech into the mix.

Can’t decide which CPaaS vendor to use? Check out my CPaaS vendor selection matrix: